The Angst of a Grizzled and Weathered Portfolio and Wealth Manager

Image Courtesy of ChatGPT

OK, let’s start with it right out of the gates. Would I have loved to have bought the NASDAQ three years ago at around 10,000? You bet! At the October close of 23,700 that would be a 137% return over three years. Who wouldn’t want that kind of return?

The real question is, would I have bought NVIDIA, or any of the related Mag 7s three years ago based on their fundamentals? Absolutely not.

Do I sound agitated by this? Maybe a little. I ask myself, “Where is this coming from?” And the answer is very clear: experience. I have read this story before. I have had clients in tears on the other end of the phone or in my office and I did not enjoy it.

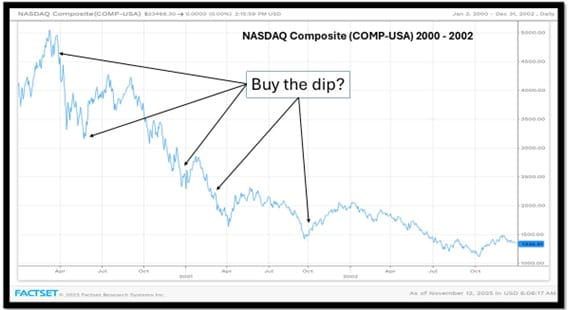

I was introduced to the markets in the early eighties, saw my first market crash in ‘87 (Black Monday) but truly cut my teeth during the Tech Wreck of the early 2000s. The NASDAQ began its relentless 78% decline on March 10, 2000 and, over an agonizing 31 months, bottomed on October 9, 2002. You could buy the dip all you wanted. If you did, you were left bloodied and homeless.

Do I feel that today’s market seems the same as the years, months or days leading up to the Dot-Com Bubble? In many ways, I do. In the famous words of Mark Twain: “History doesn’t repeat itself, but it does rhyme.”

In many ways, this market has the potential to have a worse outcome. The blind euphoria of market participants is without experience and yes, irritating, to say the least. The last real market crash was the GFC that started in October 2007, pulled the markets down 50% and took around 17 months to get there. That means (outside of the COVID blip), the last time the markets were battered and bruised was over 15 years ago.

Lehman Brothers started out in 1850 as a dry goods store. It evolved into one of America’s largest global financial services firms and had around 25,000 employees when it went bankrupt in 2008.

Leverage is currently rampant on most levels.

Options volume is at historic highs. Retail (versus institutional) traders are using call options as extreme bets. Margin debt is rising. Product manufacturers (dealers and fund companies) are creating investment options that use leverage (both synthetic and traditional) to sell the idea of large returns to clients. Think of all the funds going into leveraged ETFs as creating a self-fulfilling prophecy. I won’t even get into what the underlying risks to the private credit market could be.

This market has become one great big gamble. Say hello to the Bet 365, FanDuel, or DraftKings of the investment world.

I feel like I have been saying the following in some way, shape or form throughout my entire career:

Invest in something you can understand. Invest in line with fundamentals. Would you pay that price for a small neighbourhood store or rental property? Be patient, wealth is not created quickly.

Our job as portfolio managers and wealth advisors is to ensure client portfolios grow and or pay out at a rate that makes the financial planning work. Relative performance is important but should never drive the investment decision making process.

On a final note, I will say, as per my created image at the start of this blog, that I have been playing quite a bit with various large language models (LLM) or AI chatbots and they are very entertaining. I would not say that they are “intelligent,” but they are very good at summarizing data, drawing conclusions and creating content.

I still wouldn’t invest in them as a business though. They are extremely expensive to run (computer hardware, land and power), have no economies of scale and have a limited life span (how long will that NVIDIA chip last?). Show me the free cash flow!

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Les Consenheim, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member – Canadian Investor Protection Fund.